Here we are highlighting some of the moves in Metals and Mining of recent months. We start in Singapore, where Sashi Kiran Anumula is elevated by Macquarie Group from VP/Associate Director in commodities to MD-Iron Ore Trading. Previous positions have included as a trading strategist for commodity hedge fund Nareco Advisors and VP in commodities structuring for Merrill Lynch.

Also in Singapore, Arvind Bohara joins Jera/EDF joint venture Jera Global Markets to be Physical Coal Trader. At former employer Vitol he handled business development in addition to trading coal. Arvind was also a coal trader while with Swiss Singapore Overseas Enterprises Pte between 2006 and 2012.

When moving from South Africa to the UK in 2001, Chad Walls began by trading base metals for Investec Bank. For the past nine years he has been in Hong Kong as Exec. Director/Precious Metals Senior Trader for Crédit Agricole CIB. But now he is back in London, with his selection by AiX for Head of Commodities Europe.

James Shaw returns to Mitsui Bussan Commodities in London to become Executive Director, having spent nine years there mainly as a metals marketer until 2016. James has most recently been engaged in business development for Toyota Tsusho Metals.

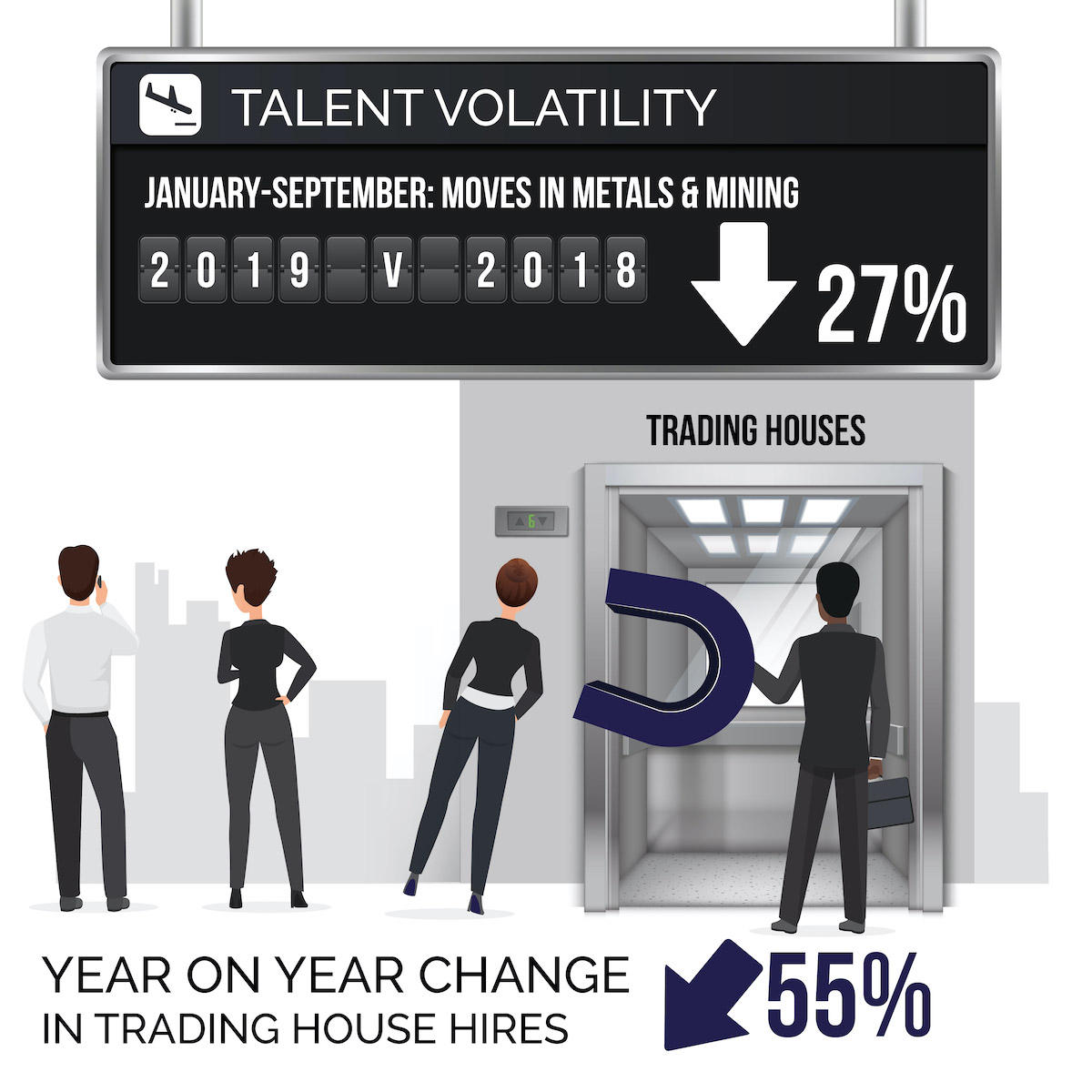

*Based on moves tracked by Commodity Appointments in last 12 months.

*Based on moves tracked by Commodity Appointments in last 12 months.

Fortis Metals has made Sebastian Voigt its Head of Sales, based in Germany. His role will see him in charge of global commercial activities for Fortis Group. Sebastian is the ex-CEO of Jinwang Europe and Global Sales Director of Hunan Jinwang Bismuth.

Across in Bridgewater, Massachusetts, Martin Madden Jr. is promoted by CNT from Commodities Trader to Head Trader - Precious Metals Trading. Now into its fifth decade of operation, CNT believes it is the largest privately-owned U.S. company in the precious metals business.

Promotion for Jodie Kelsall at Berkeley Futures in London. She becomes Trading Manager for base metals. Jodie had been LME trader and trade desk manager at the company since joining in 2008.

In Singapore, we find Diego Olaechea working for Trafigura as a metals trader, after being a copper concentrates trader in Geneva for the group. He previously worked as their former head of African metal concentrate trading, based in Johannesburg. Before this, he traded metals for Trafigura in Latin America.

Matthew Gill is made Head of Base and Precious Metal Sales by Marex Solutions in London. While a VP at previous employer Société Générale, Matthew handled sales of base metals derivatives in the Americas. He’s also a former LME floor broker, for Natixis Commodity Markets.

Started in Zug as recently as 2017, cloud-based online metals exchange Open Mineral is expanding its Swiss-based team by hiring Edouard Penot for the trade in base and precious metals. Edouard has been trading zinc, lead and tin concentrates for Transamine Trading in Geneva since 2016.

Also in Zug, Afrimet Resources has been created as an associated unit of steel trading house Vanomet, with Hadley Natus becoming its Senior Trader in tin. He comes from Zug-based metals house MRI Trading, put up for sale recently in divestment plans for the CWT International arm of Chinese conglomerate HNA. Hadley previously worked for Trafigura, first as a senior traffic operator in copper concentrates and latterly managing business development at the group’s Impala warehousing and logistics outfit in Johannesburg.

Base metals concentrates trading house Axaya has appointed Christophe Olivier to be Head of Copper Trading, operating from Zug. He follows Axaya founder Bikram Singh in having worked previously for MRI Trading, where until recently Christophe was Head of Copper and Gold Concentrates Trading.

We finish this summary with the news that Leon J. Edery has become the latest addition to the London-based precious metals sales team of BNP Paribas. It brings to an end his long association with Société Générale, his most recent position there being Director-Precious Metals Marketing & Sales. He had previously been its regional leader in precious metals sales for EMEA and the Russian Federation.

WE’RE RUNNING A SURVEY TO FIND POSSIBLE WAYS TO IMPROVE THE BASIS OF REMUNERATION FOR TRADING-TEAM ANALYSTS AND STRATEGISTS.